Successfully withstands pandemic’s impact and

demonstrates significant operational resilience

Achieves Profit Gains

Financial Highlights:

Yuexiu Transport Infrastructure Limited (“Yuexiu Transport Infrastructure” or the “Company”; stock code: 1052) announced its 2020 annual results on 9th March 2021.

During the Reporting Year, the Ministry of Transport of China extended the implementation of toll exemption for small passengers cars with seven seats or less during the spring festival holiday by 9 days apart from the original plan, and implemented toll fee exemption for cars on toll roads across the country from 17 February to 5 May 2020 (79 toll-free days in total), in response to the need for prevention and control of COVID-19 epidemic. As a result, the Company’s operating results were affected, resulting in a loss for the first time in the first half of 2020. However, since the resumption of toll from 00:00 on 6 May, most of the Company’s projects have recorded growth, which partially offset the negative impact of the interim loss. In the second half of the year, the Company’s controlling projects demonstrated a year-on-year growth of nearly 6% in average daily toll revenue. In which, Han’e Expressway, Daguangnan Expressway, Cangyu Expressway, Jinxiong Expressway and Changzhu Expressway recorded a double-digit growth in the average daily toll revenue year-on-year, indicating projects are gradually recovering and performing excellently.

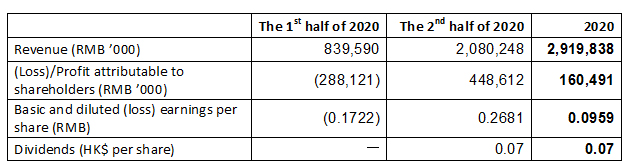

Calculated based on the full year of 2020, the Company recorded revenue of RMB 2.92 billion. Profit attributable to shareholders amounted to RMB 160 million. As the Interim results for 2020 were affected by the pandemic and the toll-free policy and losses were recorded, therefore no interim dividend was paid. However, due to business stabilization and continuous improvement of the operating environment, the Board of directors has recommended the payment of a final dividend of HK$ 0.07 per share, which is equivalent to RMB 0.0584 per share. The annual dividend payout ratio of 2020 will be 60.9%.

As announced by the Ministry of Transport, the PRC Government will, in accordance with the requirements of the relevant laws and regulations, study on the issue of related supporting and protective policies to safeguard the legitimate interest of the users, creditors, investors and operators of toll roads in a coordinated manner. It is expected that other provinces will also introduce compensation plans for the toll exemption policy of expressways during the pandemic prevention and control period, and the Company will closely monitor the relevant development.

Mr. Li Feng, Chairman of Yuexiu Transport Infrastructure, said, “Under the complicated and harsh external environment, the Chinese government has coordinated various tasks for the prevention and control of the pandemic as well as economic development, China has thus become a global leader in terms of both prevention and control effectiveness and economic performance. Satisfactory operating performance from expressway assets is expected, based on an increasing demand of travelling and car ownership resulting from growing income of residents, a stable increase of cargo transport along with the economic growth, and the irreplaceable advantage of expressway in respect of its flexibility and confidentiality for short distance transportation. The Company will still focus on key regions and strive to enhance major business by obtaining projects from different channels, and screening and proceeding with the merger and acquisition of high-quality expressways, with an aim to be a professional and focused transport infrastructure assets management company well known for its excellence in investment and financing.”

The Company’s debt level has increased due to the large-scale acquisitions completed in 2019, but is still within a healthy range. In order to balance the relationship between business expansion and financial soundness, debt reduction and restructuring optimization is also one of the Company’s priorities, including but not limited to using cash resources generated from operations, existing/new bank credit facilities and domestically registered debt financing instruments to (prepay) repay or replace existing high-interest debt. For example, the Company issued five-year corporate bonds and medium-term notes on the Shanghai Stock Exchange and the China Interbank Bond Market in January 2021, with a total size of RMB 2 billion and an average coupon rate of approximately 3.70%, which is 24-120 basis points lower than the interest rate of the existing debt replaced, resulting in significant benefits in reducing finance costs.

The China Securities Regulatory Commission released Guidelines for Publicly Offered Infrastructure Securities Investment Funds (for Trial Implementation), which provided legal basis for the domestic pilot scheme of the infrastructure REITs. The Company will capture the opportunities brought by the introduction of the new policy and strive to become one of the pilot companies for the REITs. This would be our starting point for utilizing positive interaction of the two platforms, opening up the channel for capital circulation and implementing innovation of new business models, to promote the business to the high quality and sustainability stage, with premium toll expressways in developed regions or region with high growth potential as the core, and create continuous and stable returns to our shareholders.